How to Use a Credit Card Payoff Calculator

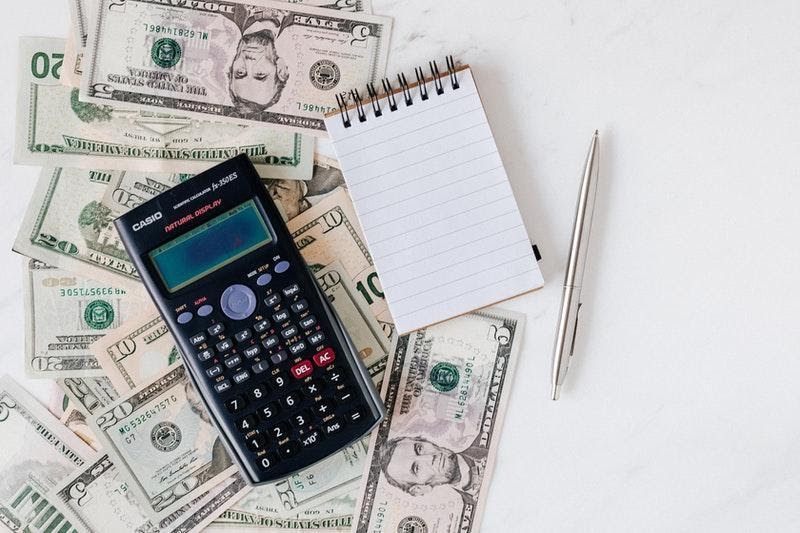

Dealing with credit card balances yourself can be quite a hassle. Laying out all your credit card balances on the table, then you whip out the calculator.

Then, you have to somehow figure out how you’ll adapt your budget to pay off your balance every month.

The next month, you’re left perplexed as you wonder why you’re nowhere near completing debt payoff. We all need to pay off debts, but wouldn’t it be better to somehow get help?

Thankfully, you can always find no-cost assistance from a credit card payoff calculator.

What is a Credit Card Payoff Calculator?

These are free online tools that estimate how much your monthly payments should be within a certain period.

These are found on various websites, mostly provided by financial counseling agencies. Even better, people are allowed to use these tools without any registration required.

While a credit card payoff calculator can’t guarantee your debt freedom, it might just pave your way to achieving it!

How to Handle Credit Card Debt

Of course, a credit card payoff calculator isn’t your only debt management option. You could request other services to help you get rid of credit card debt. Keep in mind that these also do not guarantee success.

Also, your financial problems such as your current credit limit your choices. Lenders grant loans based on your credit info, so you might get the loans with unfavorable terms and conditions.

Some of them even charge for their services, so you might have to readjust your budget.

If you’re disciplined enough, you could get rid of debts and save money using credit card payoff calculators.

Debt Consolidation

Your bank could combine your debts into one, so you can pay them off much easier. Debt consolidation usually comes as personal loans that pay off your credit card debts in one swoop.

This leaves you with just one balance with a lower interest than those from credit cards.

Alternatively, you could use balance transfer cards instead. They function similarly to consolidation loans, but with an interesting feature.

Usually, a balance transfer credit card offers an introductory period with 0% APR.

This allows you to directly tackle your original debt balance without credit card interest getting in the way.

Debt Settlement

If you’re in dire financial straits, you might ask a debt settlement company for help. They could negotiate with your lenders to lower the amount you owe.

Ironically, debt relief could harm your financial situation. These agencies usually charge exorbitant fees for their services.

Worse, they’ll require you to halt debt payments during negotiations, but they may fail to finalize a deal. You might be better off with other options, such as credit card payoff calculators.

How Can a Credit Card Payoff Calculator Help Me?

To pay off debts quicker, you need to submit amounts larger than your minimum payments. This decreases your principal quicker, so you can get rid of your debts much faster.

However, most people like you have limited budgets because you have other expenses like groceries and utilities.

Even with a regular calculator, it can be difficult to crunch the numbers. After all, it can be confusing to account for repayment terms like credit limits This is where a credit card payoff calculator could aid you.

How Does a Credit Payoff Calculator Work?

It uses your current credit card debt info to formulate your desired repayment plan. These calculators use your principal debt amount, the interest rate, and your desired number of years for payoff.

Some of them even suggest plans for short repayment periods or low monthly payments.

What’s more, you’ll find credit card payoff calculators on financial advice websites, so you may find helpful articles and services too.

Understanding your Results

After processing your information, these calculators will show the minimum payment needed to complete the payoff after a certain time.

As we’ve mentioned, it may recommend results for faster payoff or lower payments. However, these results only work if you consistently follow the online tool’s suggestions.

Compared to other options though, it requires no credit score, miscellaneous fees, or long applications.

Have discipline and determination, and your credit card payoff calculator can guide you to becoming debt-free!