https://images.unsplash.com/photo-1450101499163-c8848c66ca85

A title loan may seem like an attractive solution when you need to borrow money without having to get your credit score considered. For many people, keeping their credit score perfect in this economy has become quite a challenge. However, without a good credit score, many loan options become unavailable, which causes distress for a lot of people. This is where title loans come in. They provide a quick and convenient alternative to traditional loans, but they also have several downsides that should be considered before you take this risk. Here’s a complete guide on what title loans are, how they work, and their pros and cons.

Title Loans: Explained

A title loan is a short-term loan, usually with a repayment period of 30 days, that holds your car as collateral. Since the loan repayment is secured by your car, the lender will be legally able to repossess your car if you fail to repay the loan amount on time. These loans usually have high-interest rates, but do not have extensive requirements. Particularly, your credit score is not an issue when applying for a title loan. Additionally, the application process can take as little as 30 to 45 minutes.

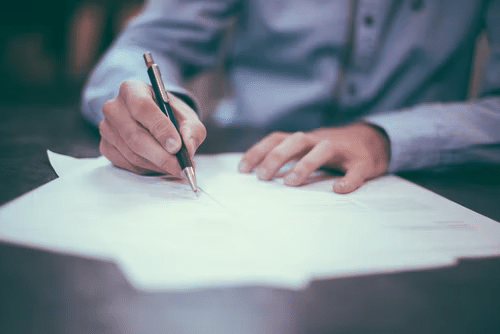

How Title Loans Work

Title loans sound simple enough, however, there are still a few requirements that you should take into consideration when applying for the loan. You need to have outright ownership of your vehicle, and a lien-free car title to be eligible for a title loan. When applying for the loan, you will have to show your car to the lender, prove your ownership of the vehicle, and provide your license and other relevant documents.

If the loan is approved, you will have to hand over the title to your vehicle to the lender in exchange for the loan. While the terms of your loan are usually set by the lender, title loans are similar to payday loans and entail a 30 day payback time. This means you will have to pay the total amount of the loan back to the lender, plus any interest and fees of the loan, at the end of the period. Most title loans have around 25% interest on the total loan amount. However, this usually varies from state to state. Plus, you also have to find a good lender who’d cooperate with you throughout the process. For people in Alabama, or in the vicinity, there are many Alabama Title Loans Online | Get Help Without the Hassle if you need to find the option to apply for the loans online. Although getting a title loan is a good option, there’s a risk that you could lose ownership of your car if you’re not able to pay back the full amount of the loan by the end of the term. So, if you do choose to apply for a title loan, make sure you pay it back on time so as to not risk losing a very valuable asset.

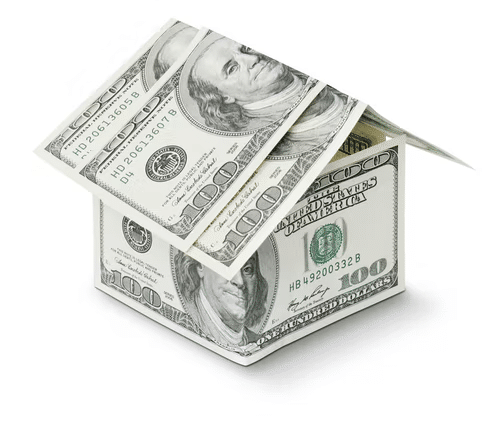

How Much Can You Borrow With A Title Loan

The usual limit for title loans ranges from around 25% to 50% of the total value of your car and is approximately $100 to $5000. However, some lenders make exceptions of up to $10,000. Once you’ve handed over the title of your car to the lender, although you’ll be allowed to drive the car still, the lender may install GPS trackers or get a spare key made for security purposes. If you default on the loan, the lender will then be able to easily track and repossess your car.

Pros And Cons

Before you can take out a title loan, it’s important that you consider the pros and cons that come with this option, and then make an informed decision.

Pros

No Credit Check: the best advantage that comes with title loans is that they do not require a credit check. To access most of these loans, you need not have a good credit score and this is exactly what makes this option so attractive.

Quick Approval: since lenders don’t have to go through extensive credit checks, it only takes them a few days to evaluate your application, check out your vehicle, and grant approval. You can access the funds just within a few days of submitting the application.

Cons

- High Interest And Fees: Title loans usually entail huge interest rates, additional fees, and charges that only add to your already existing financial burden.

- Short Repayment Time: Usually, a month’s time isn’t enough to come up with the repayment amount plus the additional fees.

- High Risk: If you can’t pay back the whole amount in the limited repayment period you’re given, you risk losing your car, which costs double the amount you borrowed.

- Potential Debt Trap: When faced with loan repayment, many people take further loans to pay back their previous loans, which leads to a cycle of debt that’s almost impossible to escape.

https://images.unsplash.com/photo-1634757439914-23b8acb9d411?ixlib=rb-1.2.1&ixid=MnwxMjA3fDB8MHxzZWFyY2h8N3x8bG9hbnxlbnwwfDB8MHx8&auto=format&fit=crop&w=500&q=60

https://images.unsplash.com/photo-1634757439914-23b8acb9d411?ixlib=rb-1.2.1&ixid=MnwxMjA3fDB8MHxzZWFyY2h8N3x8bG9hbnxlbnwwfDB8MHx8&auto=format&fit=crop&w=500&q=60

There are many circumstances where a title loan is the most feasible option for you. However, before applying for a title loan, you should make sure you’ve exhausted all alternatives since this option, although convenient, can have some downsides as well. So, do your research, and properly understand the conditions of a title loan, before you hand over your assets.