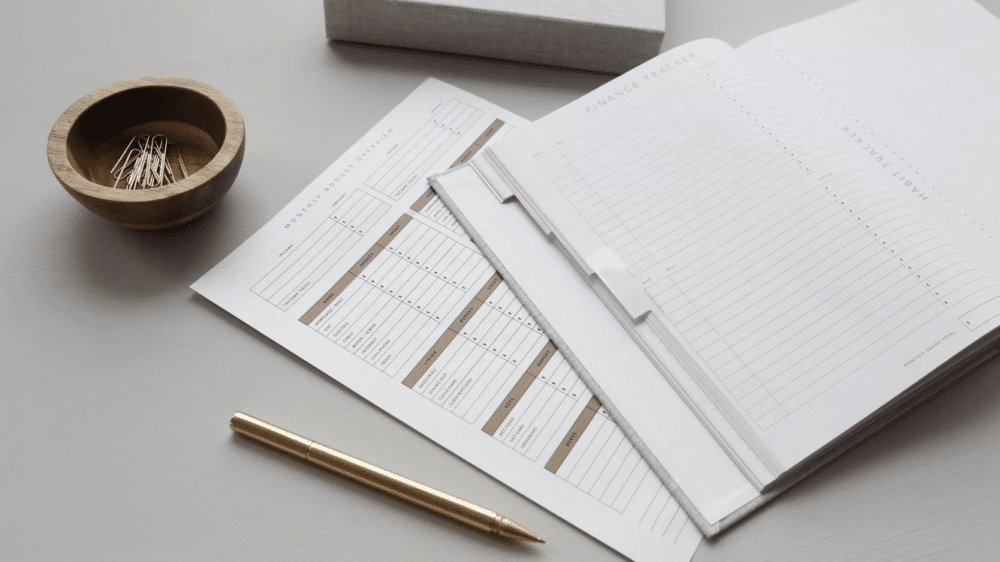

Dealing with debt and the fear of bankruptcy or foreclosure is a daunting situation. Knowing that you and your family might end up on the streets due to outstanding mortgage payments and other expenses is a frightening case that no one wishes to experience. But life happens, and being prepared to face such hardships in life is rather important since they are often inescapable. Read through our 4 financial tips on properly handling bankruptcy and foreclosure cases.

Dealing with debt and the fear of bankruptcy or foreclosure is a daunting situation. Knowing that you and your family might end up on the streets due to outstanding mortgage payments and other expenses is a frightening case that no one wishes to experience. But life happens, and being prepared to face such hardships in life is rather important since they are often inescapable. Read through our 4 financial tips on properly handling bankruptcy and foreclosure cases.

Try To Avoid Foreclosure

Before heading to buy your dream house or a fancy car you must ensure that you’ve picked the best interest rate offered. However, it’s not only about the interest rate. The amount of money you intend to pay on a monthly basis will impact your income and your ability to cater to your other expenses. Make sure you make a realistic assessment of your financial situation and plan ahead accordingly. Do not strain yourself into having a tight income after paying your mortgage and other fixed expenses. Keep in consideration that other expenses might pop up, like a sudden illness or injury due to an accident. In this case, you’ll face financial stress due to a reduction in your income.

Seek the Help of a Foreclosure Attorney

If you weren’t lucky enough to avoid foreclosure for late mortgage payments, then it’s time to seek the help of a professional attorney. The laws that regulate foreclosure cases vary from one state to another. For instance, if you’re facing foreclosure in North Carolina, the Raleigh Foreclosure defense can come up with a plan to save you. Remember that in this situation, time is your enemy. Therefore, the more time you waste in finding a sufficient solution to your problem, the worse it will get.

Work Out A Forbearance Plan

Debts can accumulate due to inadequate planning or an unrealistic assessment of your financial status. Sometimes, when you’re faced with a sudden decrease in income or an emergency situation that prevents you from paying your mortgage, you can resort to forbearance as a temporary solution. If the bank believes that your late payments are reasonably justified, it might agree to grant you better payment plans to accommodate your current financial situation. This agreement can decrease your payments and prevent foreclosure until you figure out a better solution.

Debt Settlement Programs

Debt settlement companies are one of the solutions that many indebted people adopt as an option for the payment of their debts. Although this is a risky plan, as it requires being committed to a rather long plan for deposits and monthly savings, some people still agree to these conditions. Before signing a debt settlement plan, you must review your budget closely and see if you can secure payments on their terms. One of the biggest risks of these programs is that creditors may renege on the agreement and if you stop payments, they can file a lawsuit against you. Another potential risk is the possibility of this agreement having a negative impact on your credit report. If you agree to stop paying, debts and interest will accumulate making the situation even harder to solve.

https://unsplash.com/photos/nApaSgkzaxg

https://unsplash.com/photos/nApaSgkzaxg

The pressure that debts create is overwhelming and extremely stressful. Having the right guidance and professional assistance, especially when debts are arising, can help you overcome your difficult financial situation. Many people have to face foreclosure due to unexpected emergencies, like illnesses, or a sudden decrease in their income. When finding solutions for such problems make sure you consult an experienced foreclosure lawyer to guarantee that the options given are going to improve your financial status.